Tradewiz Copy Trade Standard Settings – Capital Allocation Tips

Here’s a breakdown of the key parameters when setting up copy trade on Tradewiz, with suggested values based on proven profitable wallets.

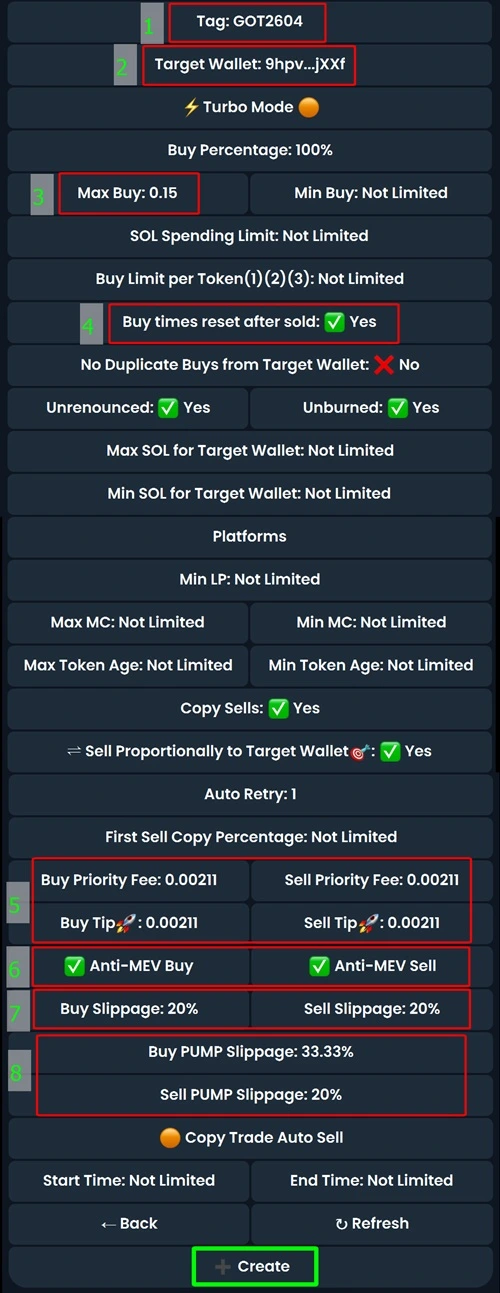

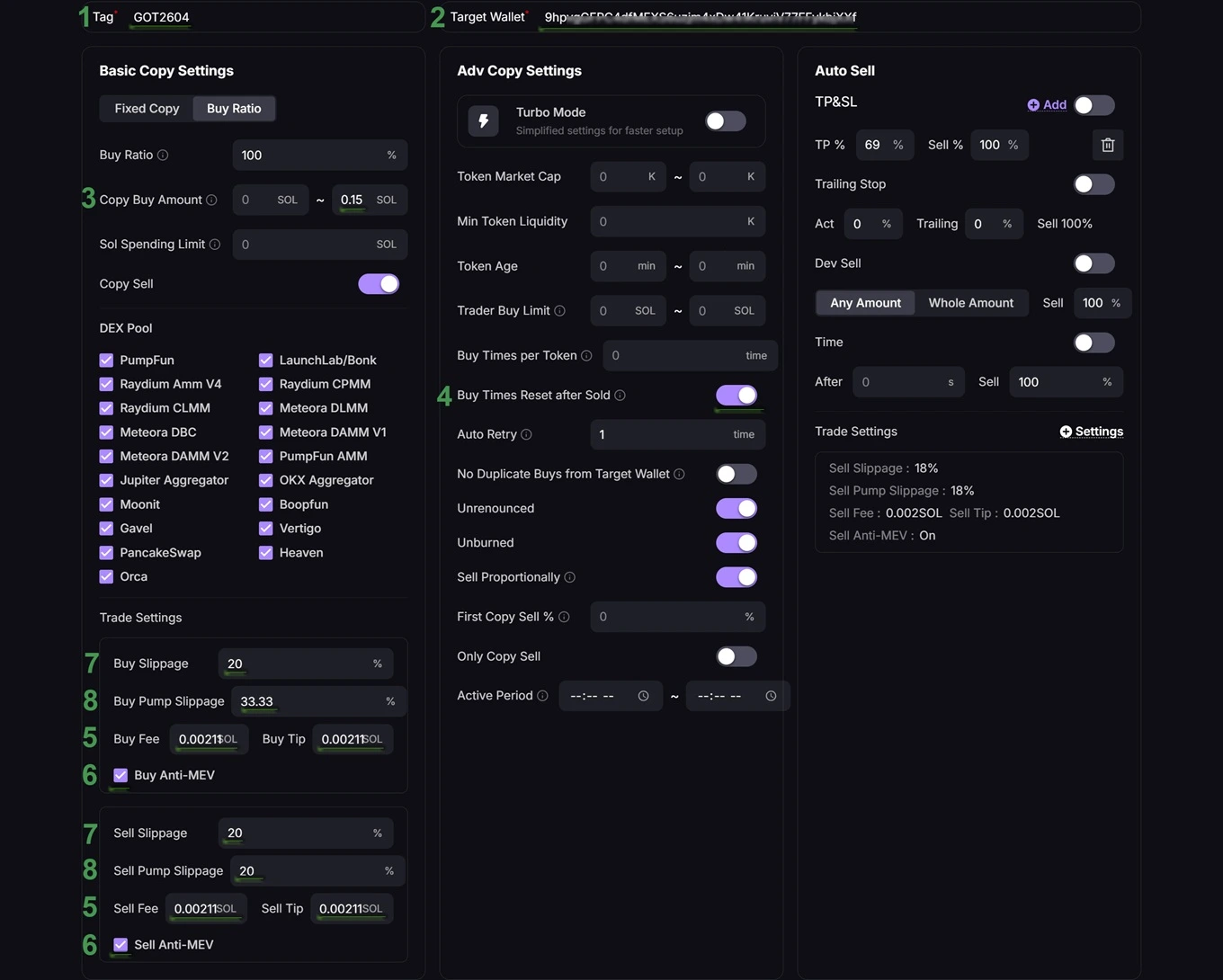

1. Tag

Give your setup a label. Keep it short and clear (e.g., Scalp Setup, Pump Sniper, Mid-term).

2. Target Wallet

This is the wallet you mirror trades from.

⚠️ Don’t all-in one wallet. Always diversify across 2–3 wallets to reduce exposure.

3. Max Buy (Per Order Cap)

Defines the maximum SOL spent per copy trade.

👉 See Capital Allocation Strategy below.

4. Buy Times Reset After Sold

Keep this ON ✅. Each time a position is closed, the counter resets — your bot stays ready to catch the next entry.

5. Priority Fee & Tip

Extra gas fee to speed up confirmation.

Recommended: 0.002 – 0.003 SOL

For hot tokens or pump entries: set slightly higher to avoid failed tx.

6. Anti-MEV (Buy/Sell)

Turn ON ✅ both sides. This prevents MEV bots from front-running your buy or dumping before your sell, protecting your PnL.

7. Slippage (Buy & Sell)

Tolerance for price movement during trade execution:

Buy: 15–20%

Sell: 10–20%💡 Too tight → failed orders. Too wide → unnecessary losses.

8. Pump Token Slippage

For Pump.fun plays:

Buy: ~33%

Sell: ~20%High slippage is needed to secure fills in extreme volatility.

💰 Capital Allocation Strategy

Small stack (1–5 SOL): Max Buy 0.05 – 0.15 SOL

Mid stack (5–20 SOL): Max Buy 0.15 – 0.3 SOL

Large stack (>20 SOL): Break into smaller positions and copy multiple wallets.

⚠️ Notes:

Trading with <1 SOL is not recommended. Network fees + tips will eat into profits.

Don’t set more than 0.5 SOL/order if you’re not experienced. High slippage on volatile tokens can wreck your entry and cause heavy losses.

📚 For the most detailed guide on Copy Trade parameters, visit TradeWiz Guides